Workers Compensation Insurance For Small Business

Workers compensation insurance for small business - Employers are legally obligated to take reasonable care to assure that their workplaces are safe. Our workers’ compensation policy is crafted to meet the needs of a wide range of classes and. Web workers compensation insurance costs small business owners an average of $47 a month, or $560 annually, according to trusted choice, a group for independent insurance agents. Because people you deal with may require it. Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured. Web the average cost of a workers’ compensation insurance policy is $45 per month, or $542 annually, for small businesses. Web workers compensation insurance pays for medical care, lost wages and other benefits should an employee get hurt or sick on the job. Web your business may require certain types of insurance, either: Web what is workers compensation insurance? For an individual business owner, this.

Web let’s say you’re a small business owner from texas. Protection for your workers insurance business. In arkansas, if you have fewer than 3 employees, you. This is based on the median cost of workers' comp insurance. Web workers' compensation insurance is vital for small businesses because it helps them cover the cost of medical expenses and lost wages for injured workers.

WORKERS COMPENSATION INSURANCE IDAHO Workers compensation insurance

So is getting your policy from an insurer you can. Workers’ comp insurance isn’t required there. Web small business insurance costs around $300 a month total, depending on what types of coverage you need.

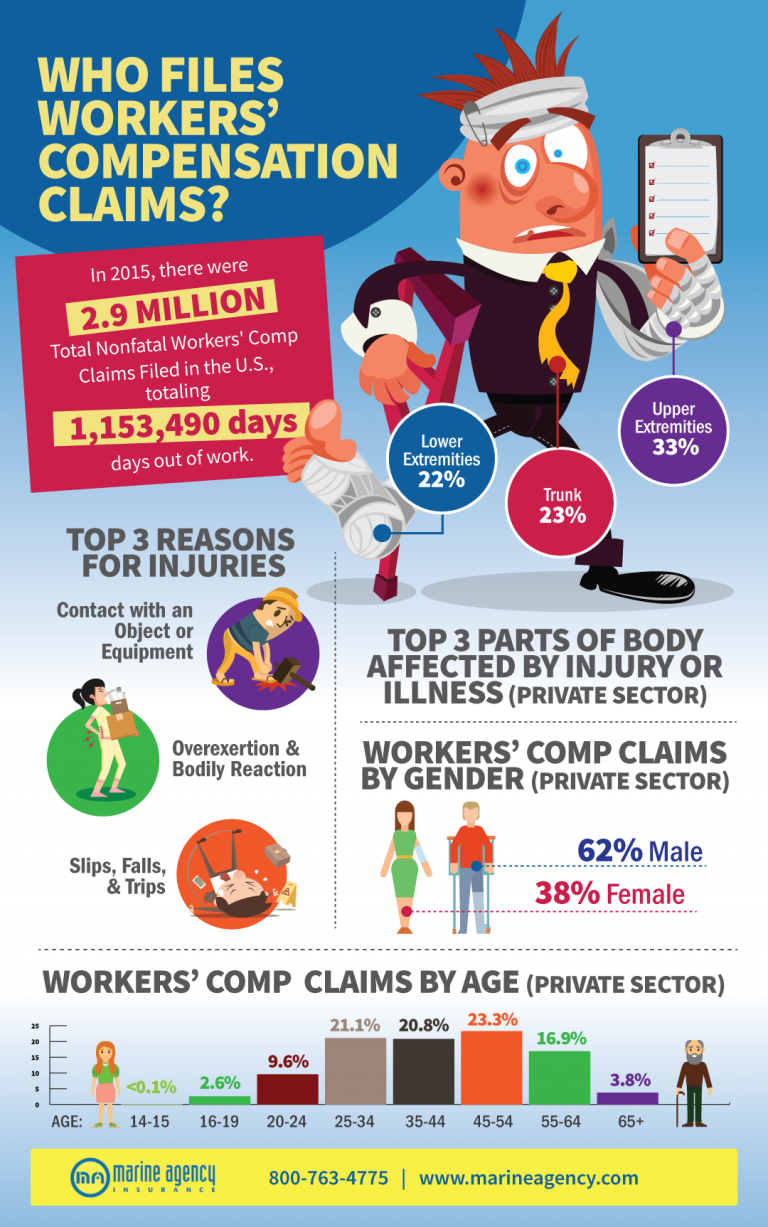

Show ImageYour Business Should Have Workers' Compensation Insurance [Infographic

Workers comp insurance costs an average of $1. Web workers' compensation insurance is vital for small businesses because it helps them cover the cost of medical expenses and lost wages for injured workers. Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured.

Show ImageWorkers' Compensation Insurance for Small Business Surety First

Web let’s say you’re a small business owner from texas. Web workers compensation insurance costs small business owners an average of $47 a month, or $560 annually, according to trusted choice, a group for independent insurance agents. For an individual business owner, this.

Show ImageWorkers’ Compensation Insurance Requirements, Cost & Providers

For an individual business owner, this. Web the payroll of the business and any past workers comp claims also impact workers compensation premiums. The average monthly price was $111.

Show ImageWorkers Compensation Insurance Quotes Free & Secure EINSURANCE

Web small business workers' compensation coverage highlights. The insurance policy will cover medical expenses, disability coverage, employer liability,. Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured.

Show ImageCheap Workers Compensation Insurance Small Business

Because people you deal with may require it. Protection for your workers insurance business. Web workers’ comp insurance from a trusted source.

Show ImageWorkers' Compensation Insurance What You Should Know The Schwab Agency

Web workers’ comp insurance from a trusted source. Web the payroll of the business and any past workers comp claims also impact workers compensation premiums. Web what is workers compensation insurance?

Show ImageWorkers Compensation Insurance 101 Guide for Small Business Owners

In arkansas, if you have fewer than 3 employees, you. Web although 1099 contractors aren’t required by law to have workers’ compensation insurance, they may choose to buy a workers’ compensation policy. Workers’ comp insurance isn’t required there.

Show ImageWorkers’ Compensation Insurance A Primer Nova Science Publishers

So is getting your policy from an insurer you can. Web an assigned risk pool or assigned risk plan is a workers’ compensation insurance program that will sell coverage to businesses that are denied by private. Web workers’ compensation insurance is required by law in almost every state.

Show ImageBest Workers Comp Insurance For Small Business

Web workers’ compensation insurance is required by law in almost every state. For an individual business owner, this. Web workers’ compensation insurance offers many benefits to small businesses, including:

Show ImageWeb workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured. Web small business insurance costs around $300 a month total, depending on what types of coverage you need. Because people you deal with may require it. Web your business may require certain types of insurance, either: Web workers' compensation insurance is vital for small businesses because it helps them cover the cost of medical expenses and lost wages for injured workers. Web workers’ comp insurance from a trusted source. This is based on the median cost of workers' comp insurance. By law (such as workers' compensation insurance), or. Meeting your workers’ comp insurance obligation is essential. Web small business workers' compensation coverage highlights.

So is getting your policy from an insurer you can. Web in 2021, the national median cost for workers’ compensation insurance through progressive was $65 per month. Protection for your workers insurance business. Web like group health insurance requirements, small business owners may be required by law to have workers’ compensation insurance, depending on the number. Employers are legally obligated to take reasonable care to assure that their workplaces are safe. Our workers’ compensation policy is crafted to meet the needs of a wide range of classes and. Web an assigned risk pool or assigned risk plan is a workers’ compensation insurance program that will sell coverage to businesses that are denied by private. The insurance policy will cover medical expenses, disability coverage, employer liability,. Web workers compensation insurance costs small business owners an average of $47 a month, or $560 annually, according to trusted choice, a group for independent insurance agents. Web although 1099 contractors aren’t required by law to have workers’ compensation insurance, they may choose to buy a workers’ compensation policy.

Web let’s say you’re a small business owner from texas. Web workers’ compensation insurance is required by law in almost every state. Web the payroll of the business and any past workers comp claims also impact workers compensation premiums. Web workers’ compensation insurance offers many benefits to small businesses, including: Web workers compensation insurance pays for medical care, lost wages and other benefits should an employee get hurt or sick on the job. Workers’ comp insurance isn’t required there. Web what is workers compensation insurance? The average monthly price was $111. Web the average cost of a workers’ compensation insurance policy is $45 per month, or $542 annually, for small businesses. Web workers’ compensation insurance policies cost an average of $45 per month.