Workers Comp And General Liability Insurance

Workers comp and general liability insurance - Web most businesses should have both general liability and workers’ compensation insurance. Web general liability insurance protects your company when a client or another third party suffers an injury on your property and sues for medical expenses. But there are four “monopolistic states” that do not include. Web general liability insurance protects a business against claims of bodily injury and property damage from customers and clients. Additionally, 29% pay less than $30. Some states require workers’ comp coverage if these employees work more. Web on average, insureon customers pay $42 per month, or about $500 annually, for a $1 million general liability insurance policy. Web general liability covers you in the event that a customer or client sustains an injury on your property; Web domestic workers employed in private homes, like house cleaners and nannies. Web workers’ compensation insurance is a specific type of insurance coverage required by law for nearly every business, with a few exceptions.

Web commercial insurance can be affordable. Web general liability insurance costs an average of $42 a month, according to insureon. Web companies known for personal insurance, like state farm, farmers and progressive, also offer workers’ comp and employer’s liability insurance. Web general liability and workers’ compensation insurance are similar in that they both provide coverage for bodily injuries. One focuses on injuries to third parties like your.

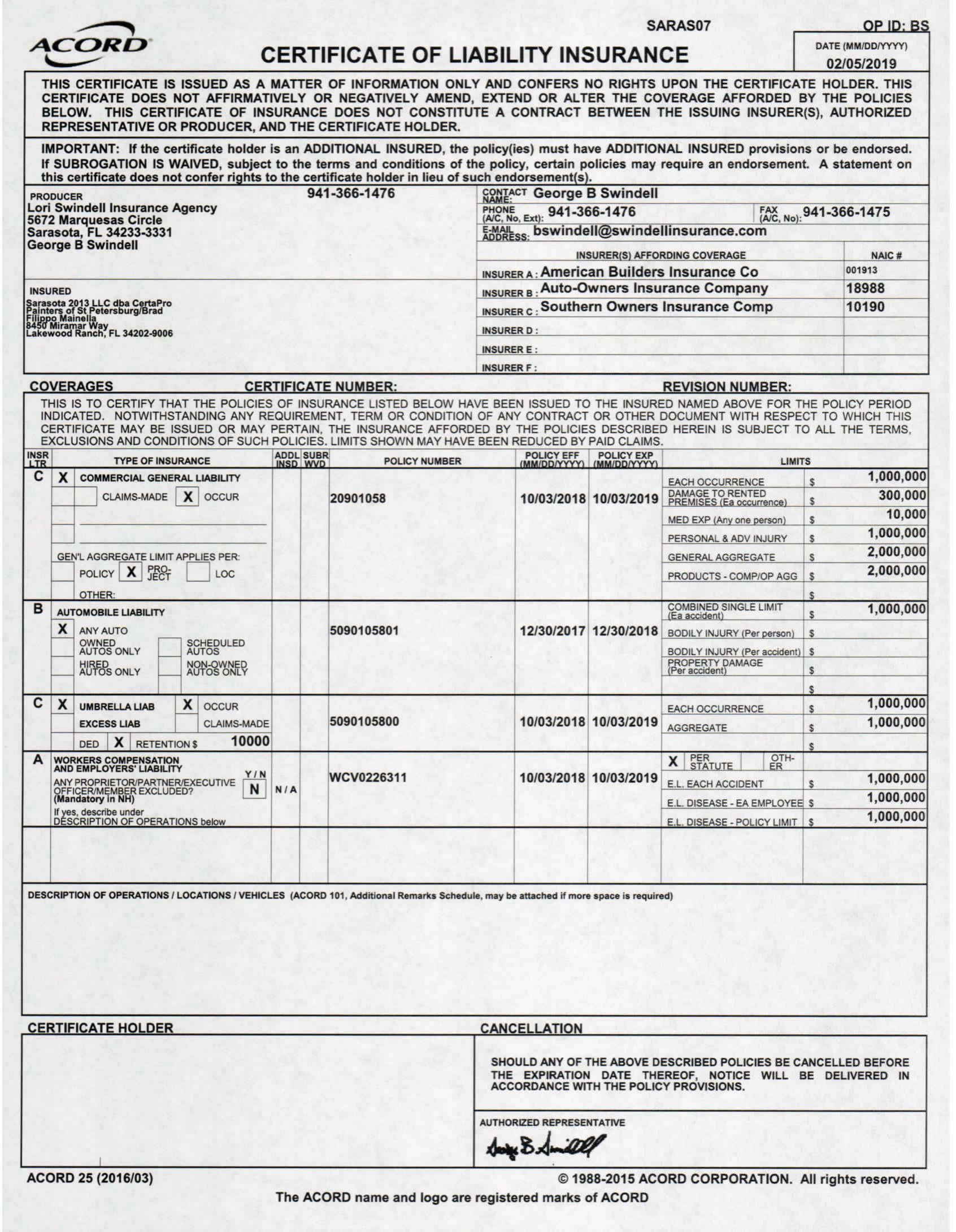

General Liability Insurance CertaPro Painters of St Petersburg

Web workers’ compensation insurance is a specific type of insurance coverage required by law for nearly every business, with a few exceptions. Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured or. The purpose of workers’ comp.

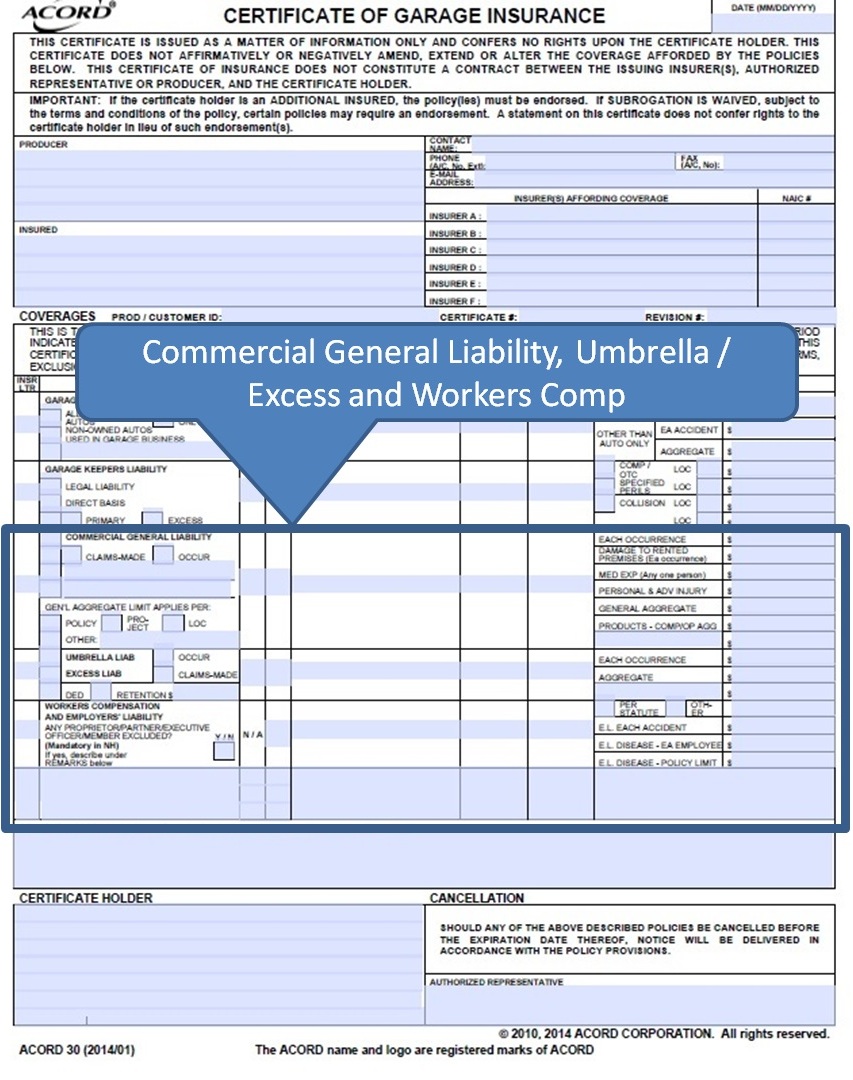

Show ImageSimplyEasierACORDForms Instructions ACORD 30 General Liability

Bundle with commercial property insurance for savings in a. The purpose of workers’ comp. Web this insurance policy helps pay for the repair or replacement of paint sprayers, brushes, and other tools and equipment if they are lost, stolen, or damaged.

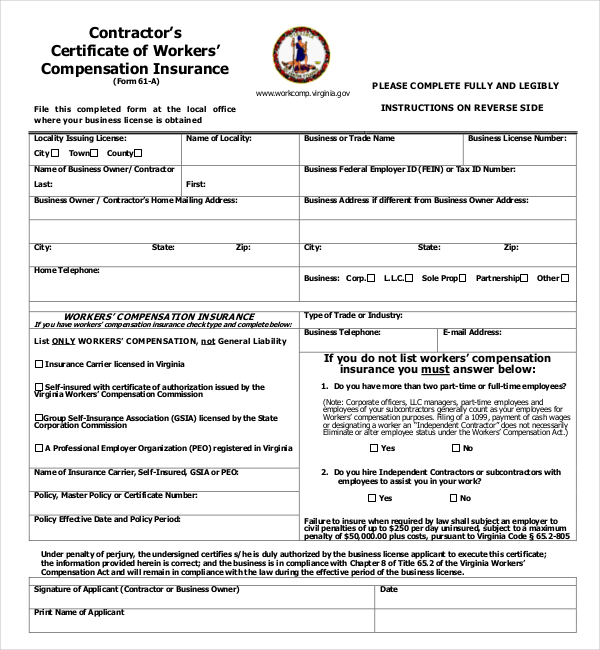

Show ImageFREE 13+ Sample Workers Compensation Forms in PDF XLS Word

Web franzyck argued that an employer has a public duty to assist an employee in exercising its right to sue the third party, but the court warned that imposing such a. Web general liability covers you in the event that a customer or client sustains an injury on your property; Median costs for small business owners are:

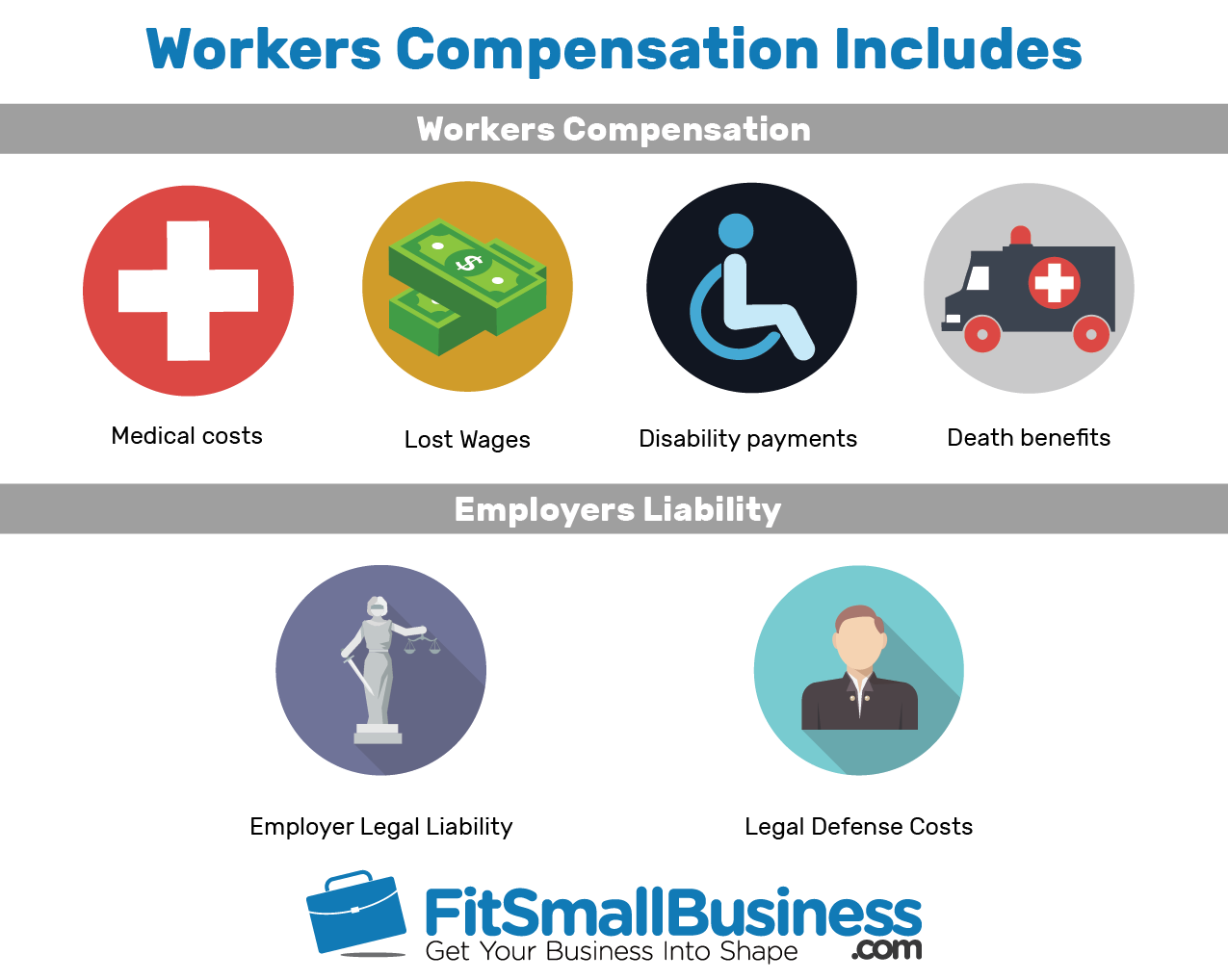

Show ImageWorkers’ Compensation Insurance Requirements, Cost & Providers

Web general liability covers you in the event that a customer or client sustains an injury on your property; But there are four “monopolistic states” that do not include. These business insurance policies help protect your business from different types of.

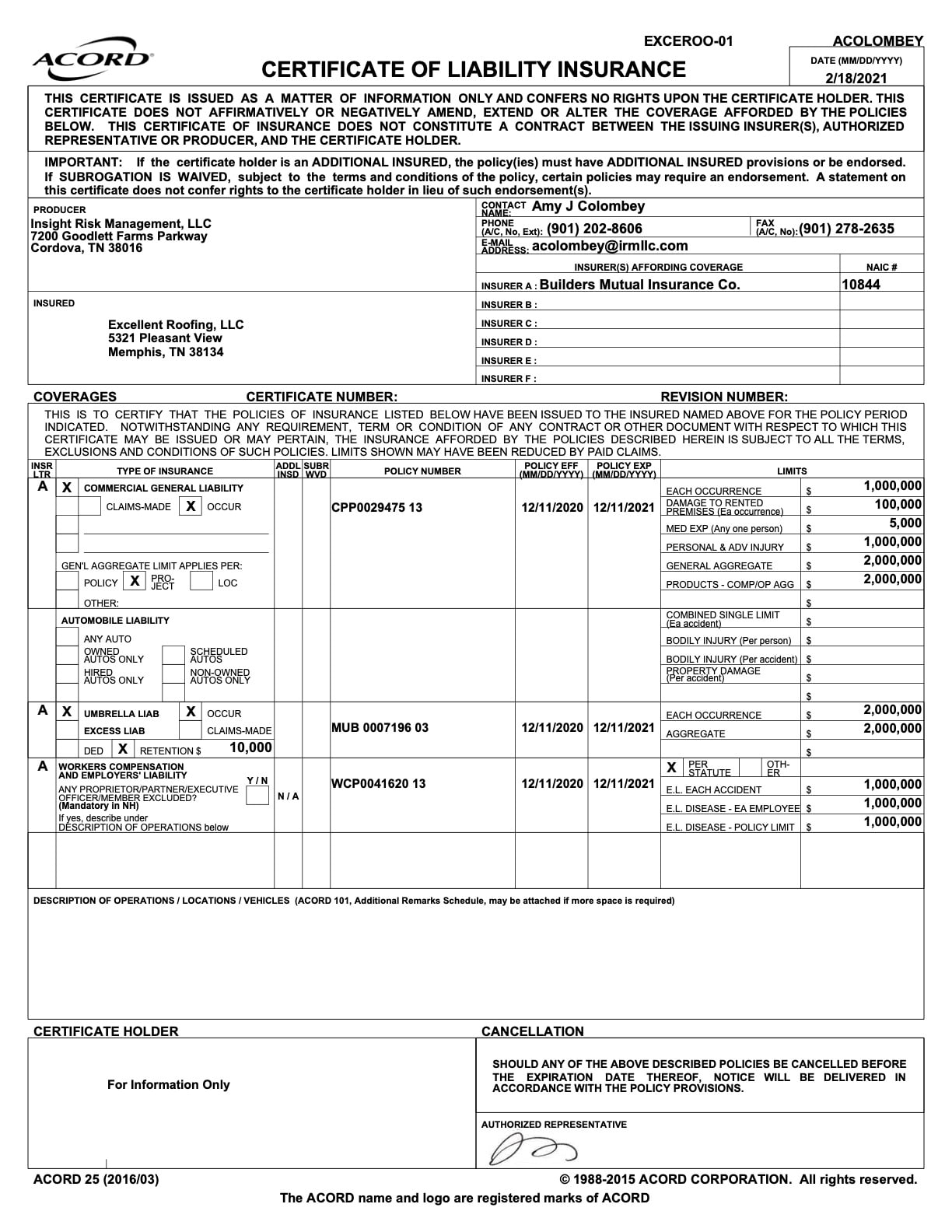

Show ImageWorkers Compensation Workers Compensation Certificate Of Insurance Form

Web general liability insurance costs an average of $42 a month, according to insureon. The average monthly price was $111. Additionally, 29% pay less than $30.

Show ImageDo i need workers compensation insurance if i am self employed insurance

General liability covers injuries that occur to people who visit your workplace. Additionally, 29% pay less than $30. Web workers’ compensation insurance is a specific type of insurance coverage required by law for nearly every business, with a few exceptions.

Show ImageWorkers’ Compensation Insurance Requirements, Cost & Providers

Web workers’ compensation insurance is a specific type of insurance coverage required by law for nearly every business, with a few exceptions. Some states require workers’ comp coverage if these employees work more. The average cost of a slip and fall accident is $20,000, according to the.

Show ImageLicensed and Insured Roofing Contractor Excellent Roofing

The purpose of workers’ comp. Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured or. Web domestic workers employed in private homes, like house cleaners and nannies.

Show ImageWorkers' Compensation Insurance for Small Business Surety First

Web general liability insurance costs an average of $42 a month, according to insureon. General liability covers injuries that occur to people who visit your workplace. These types of claims may.

Show ImageInsurance Workers Comp Certificate

Web they seem similar because they both, in part, offer protection against injuries. The average workers’ compensation premium is $45 per month, or roughly $540 per year, according to data. Web commercial insurance can be affordable.

Show ImageWeb commercial insurance can be affordable. The average workers’ compensation premium is $45 per month, or roughly $540 per year, according to data. Web domestic workers employed in private homes, like house cleaners and nannies. Web they seem similar because they both, in part, offer protection against injuries. Web most businesses should have both general liability and workers’ compensation insurance. These types of claims may. General liability covers injuries that occur to people who visit your workplace. Web general liability insurance protects a business against claims of bodily injury and property damage from customers and clients. Web general liability insurance costs an average of $42 a month, according to insureon. Web companies known for personal insurance, like state farm, farmers and progressive, also offer workers’ comp and employer’s liability insurance.

Web general liability insurance protects your company when a client or another third party suffers an injury on your property and sues for medical expenses. Workers’ comp covers you if an employee sustains an injury. Web workers’ compensation insurance is a specific type of insurance coverage required by law for nearly every business, with a few exceptions. Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured or. One focuses on injuries to third parties like your. Median costs for small business owners are: Web franzyck argued that an employer has a public duty to assist an employee in exercising its right to sue the third party, but the court warned that imposing such a. Web in 2021, the national median cost for workers’ compensation insurance through progressive was $65 per month. Web general liability covers you in the event that a customer or client sustains an injury on your property; Web average cost of workers’ compensation insurance.

The average cost of a slip and fall accident is $20,000, according to the. But there are four “monopolistic states” that do not include. Additionally, 29% pay less than $30. The average monthly price was $111. Web general liability and workers’ compensation insurance are similar in that they both provide coverage for bodily injuries. These business insurance policies help protect your business from different types of. The purpose of workers’ comp. Bundle with commercial property insurance for savings in a. Some states require workers’ comp coverage if these employees work more. Web this insurance policy helps pay for the repair or replacement of paint sprayers, brushes, and other tools and equipment if they are lost, stolen, or damaged.