Small Business Workers Comp Insurance

Small business workers comp insurance - Web the best small business workers’ comp insurance providers know that, and they work to find you optimal pricing. Web workers comp insurers help you assess the injured worker's needs and capabilities and encourage you to let workers know, in advance of any injury, that you will try to modify. Web while the laws vary between states, most states require all employers, including small business owners, to have workers’ compensation insurance. Annual premiums for workers' compensation insurance can cost a small business anywhere from a few hundred. Business insurance made simple compare free. Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured. Web although 1099 contractors aren’t required by law to have workers’ compensation insurance, they may choose to buy a workers’ compensation policy and. Web businesses buy workers comp insurance for employees and this insurance is required in most states. So is getting your policy from an insurer you can. This is based on the median cost of workers' comp insurance.

Meeting your workers’ comp insurance obligation is essential. While insureon's small business customers pay an average of $45 monthly for workers’. Web workers comp is a crucial component of a small business insurance plan. Here are tips for saving money on it. It’s been in business since 1901 and offers a range of business.

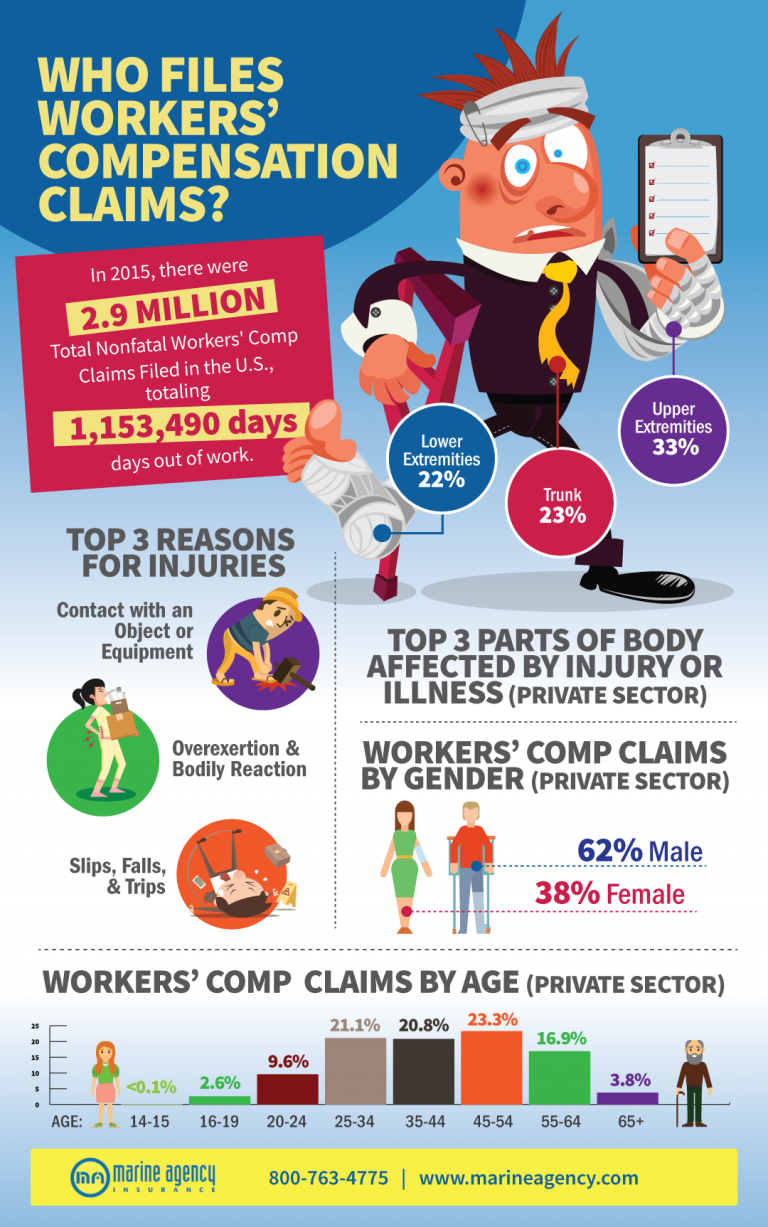

How small businesses can reduce their Workers' Comp risk

Annual premiums for workers' compensation insurance can cost a small business anywhere from a few hundred. Web typical workers' compensation premiums for insureon customers. Web workers compensation insurance costs small business owners an average of $47 a month, or $560 annually, according to trusted choice, a group for independent insurance agents.

Show ImageIs Workers' Comp Insurance Mandatory for Small Businesses? YouTube

Web the best small business workers’ comp insurance providers know that, and they work to find you optimal pricing. Web workers’ compensation insurance policies cost an average of $45 per month. So is getting your policy from an insurer you can.

Show ImageYour Business Should Have Workers' Compensation Insurance [Infographic

Web more like this small business. While insureon's small business customers pay an average of $45 monthly for workers’. So is getting your policy from an insurer you can.

Show ImageWorkers’ Comp What Small Business Owners Should Know Webb Insurance

Web workers compensation insurance costs small business owners an average of $47 a month, or $560 annually, according to trusted choice, a group for independent insurance agents. Here are tips for saving money on it. Web workers comp insurers help you assess the injured worker's needs and capabilities and encourage you to let workers know, in advance of any injury, that you will try to modify.

Show ImagePie Insurance Workers' Comp for Small Businesses Workers comp

While insureon's small business customers pay an average of $45 monthly for workers’. Web workers comp insurers help you assess the injured worker's needs and capabilities and encourage you to let workers know, in advance of any injury, that you will try to modify. It’s been in business since 1901 and offers a range of business.

Show ImageThe 13 Benefits of Workers Comp Insurance Advantage Insurance Solutions

Workers comp insurance for small business,. Web in 2021, the median monthly cost of workers’ compensation insurance was $65 for new progressive customers. This is based on the median cost of workers' comp insurance.

Show ImageSmall Business Workers Comp Insurance Florida

Web while the laws vary between states, most states require all employers, including small business owners, to have workers’ compensation insurance. So is getting your policy from an insurer you can. Web typical workers' compensation premiums for insureon customers.

Show ImageWorkers’ Compensation Insurance Requirements, Cost & Providers

Meeting your workers’ comp insurance obligation is essential. It’s been in business since 1901 and offers a range of business. Web more like this small business.

Show ImageWORKERS COMPENSATION INSURANCE IDAHO Workers compensation insurance

Web while the laws vary between states, most states require all employers, including small business owners, to have workers’ compensation insurance. The average rate was $111 per month. Web workers’ comp insurance from a trusted source.

Show ImageAn Insight Into The Benefits Of Workers Compensation Insurance

Web workers comp is a crucial component of a small business insurance plan. Web while the laws vary between states, most states require all employers, including small business owners, to have workers’ compensation insurance. Meeting your workers’ comp insurance obligation is essential.

Show ImageHere are tips for saving money on it. Workers comp insurance for small business,. Web although 1099 contractors aren’t required by law to have workers’ compensation insurance, they may choose to buy a workers’ compensation policy and. Web workers’ comp insurance from a trusted source. Web while the laws vary between states, most states require all employers, including small business owners, to have workers’ compensation insurance. Here are tips for saving money on it. Web typical workers' compensation premiums for insureon customers. Web businesses buy workers comp insurance for employees and this insurance is required in most states. Web hiscox is a leading insurer for small businesses with over 400,000 small business clients. Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured.

Web workers comp is a crucial component of a small business insurance plan. Web workers compensation insurance costs small business owners an average of $47 a month, or $560 annually, according to trusted choice, a group for independent insurance agents. This is based on the median cost of workers' comp insurance. So is getting your policy from an insurer you can. While insureon's small business customers pay an average of $45 monthly for workers’. Web workers’ compensation insurance policies cost an average of $45 per month. Business insurance made simple compare free. The average rate was $111 per month. Web in 2021, the median monthly cost of workers’ compensation insurance was $65 for new progressive customers. Web workers comp insurers help you assess the injured worker's needs and capabilities and encourage you to let workers know, in advance of any injury, that you will try to modify.

It’s been in business since 1901 and offers a range of business. Meeting your workers’ comp insurance obligation is essential. Annual premiums for workers' compensation insurance can cost a small business anywhere from a few hundred. Web more like this small business. Web the best small business workers’ comp insurance providers know that, and they work to find you optimal pricing.