Liability And Workers Comp Insurance

Liability and workers comp insurance - Web general liability insurance protects a business against claims of bodily injury and property damage from customers and clients. Meeting your workers’ comp insurance obligation is essential. Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured or. Web workers’ comp insurance from a trusted source. So is getting your policy from an insurer you can. These business insurance policies help protect your business from different types of. But there are four “monopolistic states” that do not include. Both policies cover bodily injury, with the. Web companies known for personal insurance, like state farm, farmers and progressive, also offer workers’ comp and employer’s liability insurance. The average workers’ compensation premium is $45 per month, or roughly $540 per year, according to data.

Web workers’ compensation insurance policies cost an average of $45 per month. Web commercial insurance can be affordable. This is based on the median cost of workers' comp insurance. Web most businesses should have both general liability and workers’ compensation insurance. Web your workers' comp insurance premium is calculated based on your location, number of employees, and the risks within your particular field.

Workers’ Compensation Insurance Requirements, Cost & Providers

So is getting your policy from an insurer you can. Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured or. Web workers’ comp insurance from a trusted source.

Show Image81+ Insurance Workers Comp Certificate Hutomo Sungkar

Web your workers' comp insurance premium is calculated based on your location, number of employees, and the risks within your particular field. Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured or. Both policies cover bodily injury, with the.

Show ImageWorkers Compensation Workers Compensation Certificate Of Insurance Form

Web she covers auto, property & casualty, workers' compensation, fraud, risk and cybersecurity, and is a frequent speaker at insurance industry events. Web commercial insurance can be affordable. Web workers’ comp insurance from a trusted source.

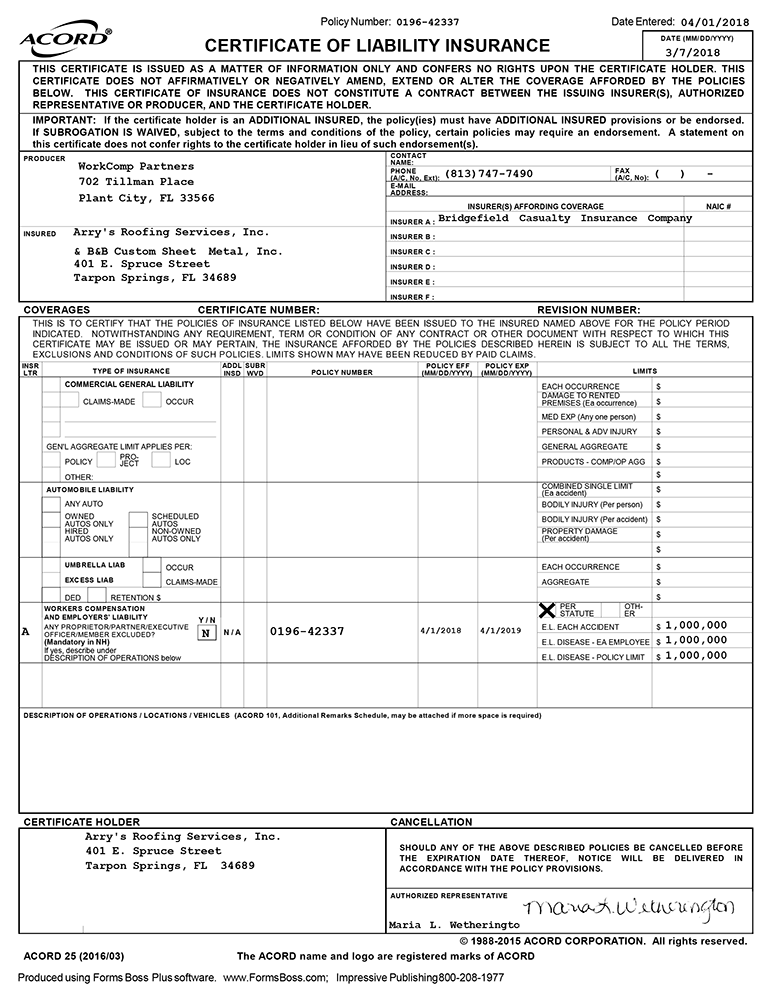

Show ImageRoofing License & Insurance Tarpon Springs Arry's Roofing Services, Inc.

This is based on the median cost of workers' comp insurance. Both policies cover bodily injury, with the. Web general liability insurance protects a business against claims of bodily injury and property damage from customers and clients.

Show ImageInsurance Workers Comp Certificate

Web california labor commissioner reaches $1.47 million wage theft settlement with poultry businesses affecting more than 300 workers. Median costs for small business owners are: These types of claims may.

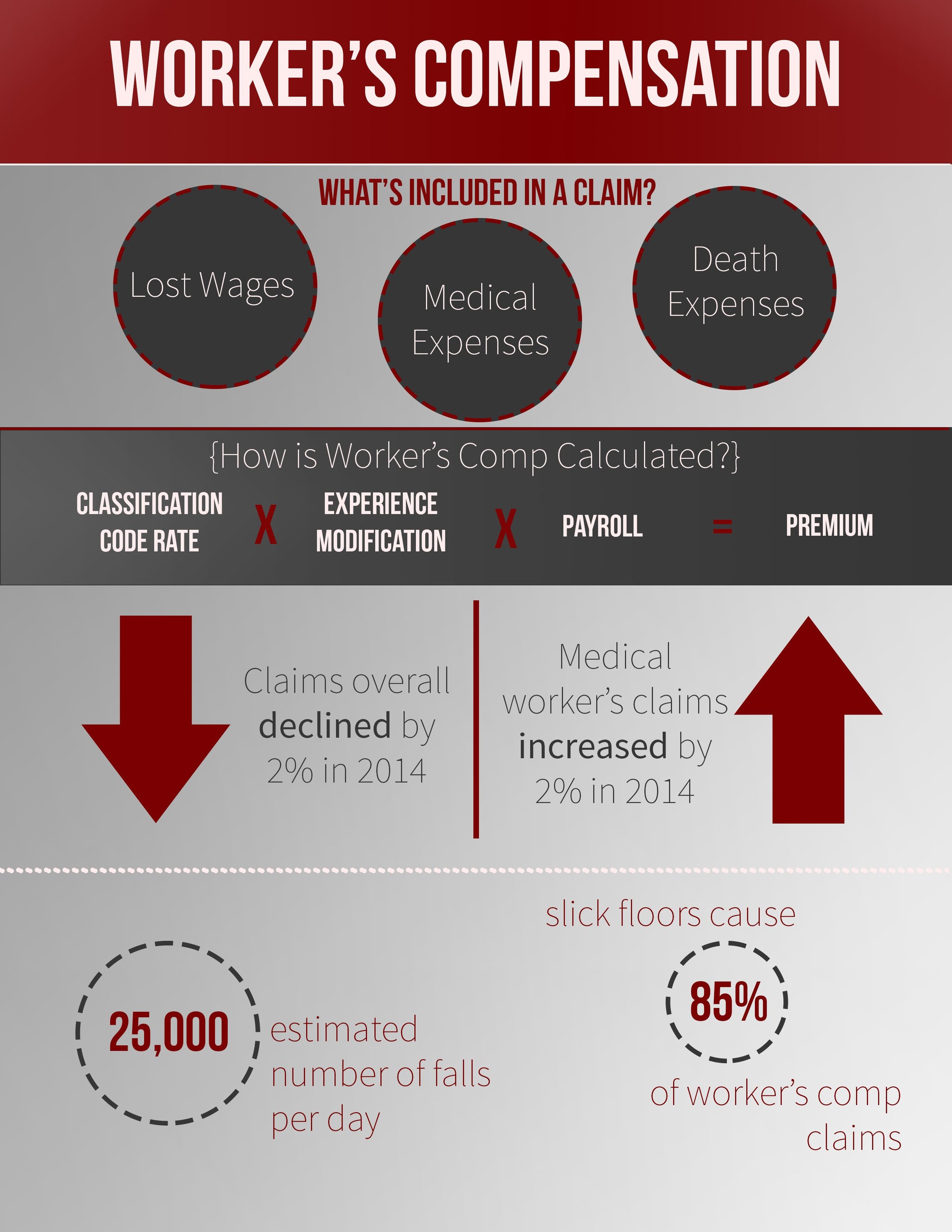

Show ImageWhat is Worker's Compensation?

Web she covers auto, property & casualty, workers' compensation, fraud, risk and cybersecurity, and is a frequent speaker at insurance industry events. These types of claims may. The average workers’ compensation premium is $45 per month, or roughly $540 per year, according to data.

Show ImageEmployers Liability Insurance

Web commercial insurance can be affordable. Web workers’ comp insurance from a trusted source. Web workers’ compensation insurance policies cost an average of $45 per month.

Show ImageWhat’s Included in Your Detailed Home Improvement Estimate On Top

Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured or. Web average cost of workers’ compensation insurance. Web most businesses should have both general liability and workers’ compensation insurance.

Show ImageEmployers' Liability Vs. Workers' Compensation Trusted Choice

Web your workers' comp insurance premium is calculated based on your location, number of employees, and the risks within your particular field. Web average cost of workers’ compensation insurance. But there are four “monopolistic states” that do not include.

Show ImageInsurance Get

Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured or. This is based on the median cost of workers' comp insurance. So is getting your policy from an insurer you can.

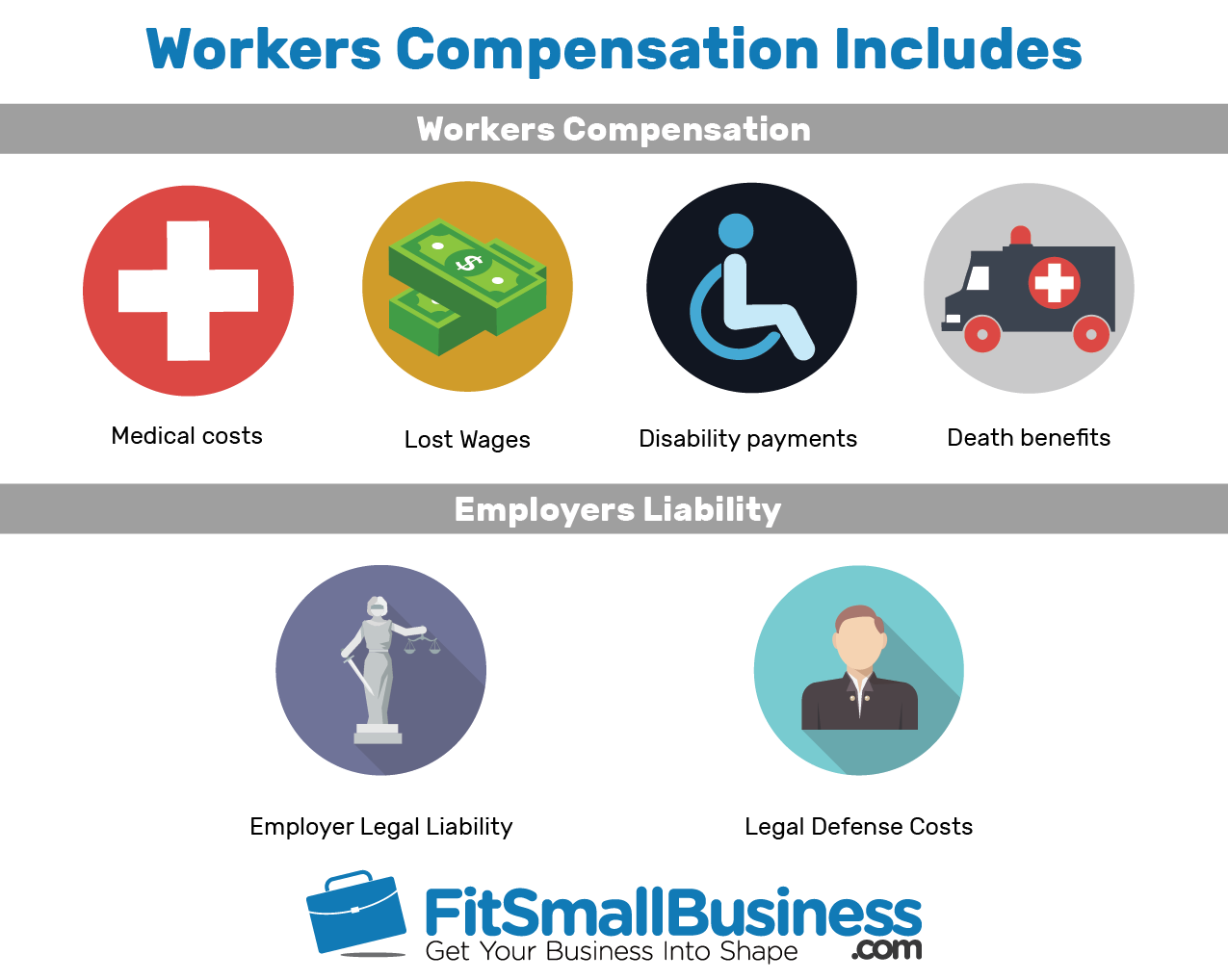

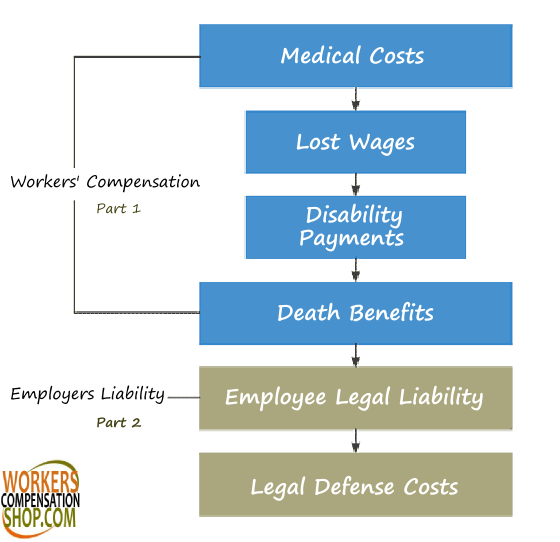

Show ImageWeb your workers' comp insurance premium is calculated based on your location, number of employees, and the risks within your particular field. Meeting your workers’ comp insurance obligation is essential. Web in most states, employer’s liability insurance is included as part of workers compensation insurance. Web companies known for personal insurance, like state farm, farmers and progressive, also offer workers’ comp and employer’s liability insurance. Web workers' compensation insurance, also called workers' comp insurance, helps cover medical expenses and lost wages for small business owners if an employee is injured or. This is based on the median cost of workers' comp insurance. But there are four “monopolistic states” that do not include. Web most businesses should have both general liability and workers’ compensation insurance. These types of claims may. These business insurance policies help protect your business from different types of.

Web in the following conversation, paczolt shared with risk & insurance how a mere 10% of workers’ comp claims end up accounting for 80% of costs. Web although general liability and workers’ compensation have certain parallels, they also have some significant distinctions. Both policies cover bodily injury, with the. Web workers’ comp insurance from a trusted source. Web average cost of workers’ compensation insurance. Median costs for small business owners are: Web commercial insurance can be affordable. Web workers’ compensation insurance policies cost an average of $45 per month. So is getting your policy from an insurer you can. The average workers’ compensation premium is $45 per month, or roughly $540 per year, according to data.

Web general liability insurance protects a business against claims of bodily injury and property damage from customers and clients. Web she covers auto, property & casualty, workers' compensation, fraud, risk and cybersecurity, and is a frequent speaker at insurance industry events. Web california labor commissioner reaches $1.47 million wage theft settlement with poultry businesses affecting more than 300 workers.