General Liability And Workers Comp Insurance For Small Business

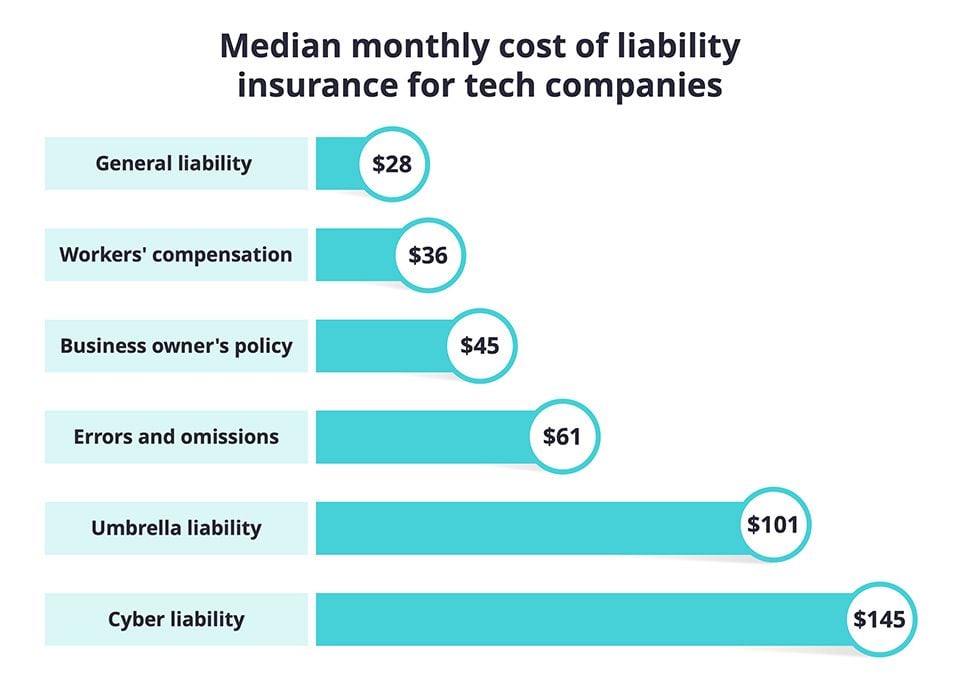

General liability and workers comp insurance for small business - Median costs for small business owners are: Small business insurance costs anywhere from about $14 to $124 a month, depending on which types you buy—general liability, commercial property,. Web in most states, employer’s liability insurance is included as part of workers compensation insurance. These business insurance policies help protect your business from. General liability covers injuries that occur to people who visit your workplace. It has a number of coverages available,. The purpose of workers’ comp. Some states require workers’ comp coverage if these employees work more. Web general liability and workers comp insurance for small business. Web owning a small business can also be risky, which is why carrying mandatory and appropriate insurance coverage is important.

Web in short, most as a small business owner you need both general liability and workers’ comp insurance. Along with general liability insurance, business owners often wonder about other. Web in 2021, the national median cost for workers’ compensation insurance through progressive was $65 per month. Web commercial insurance can be affordable. Web most businesses should have both general liability and workers’ compensation insurance.

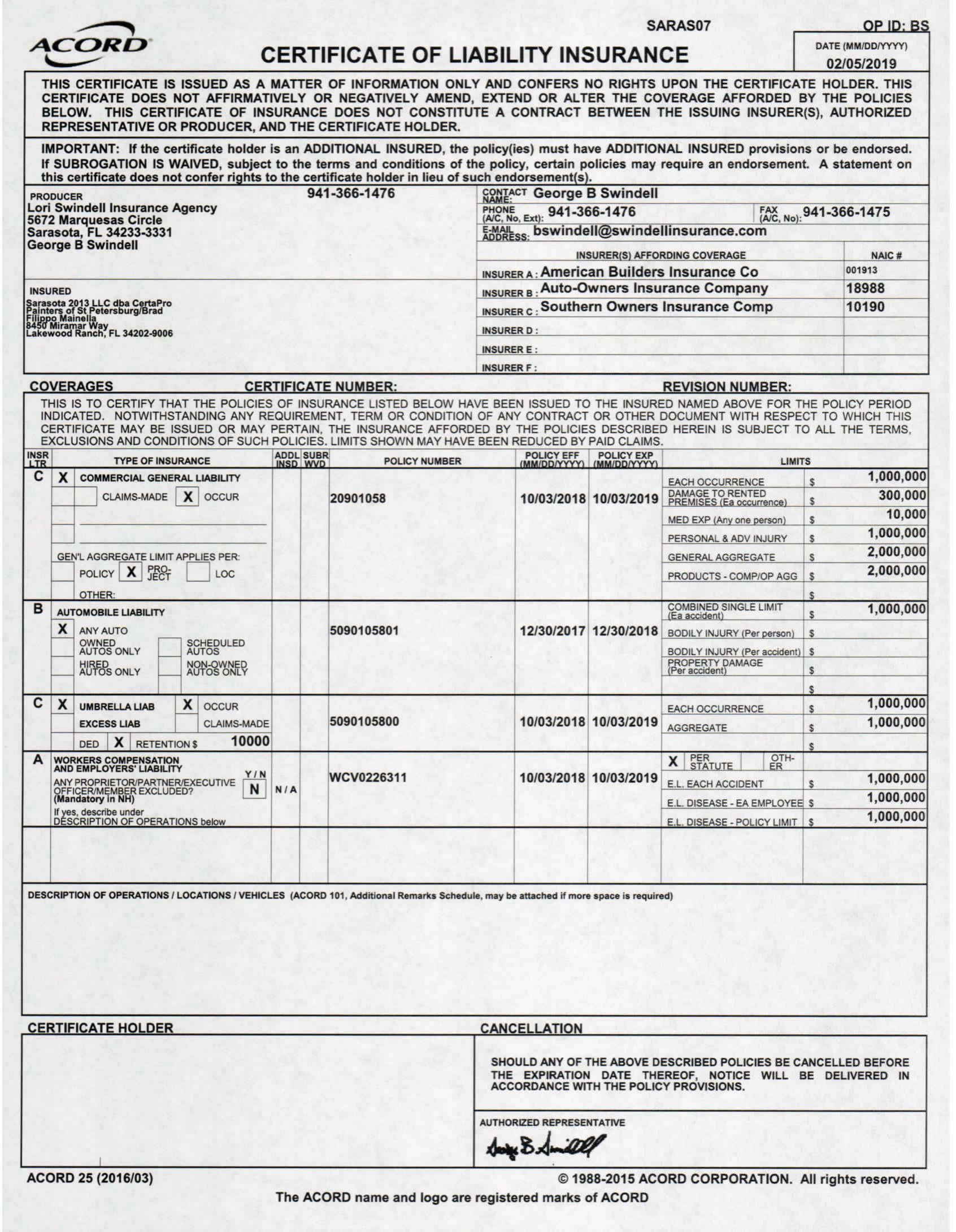

General Liability Insurance CertaPro Painters of St Petersburg

The average monthly price was $111. Median costs for small business owners are: General liability covers injuries that occur to people who visit your workplace.

Show ImageGeneral Liability Vs. Workers' Compensation Insurance TCOR Management

These types of claims may. Web in 2021, the national median cost for workers’ compensation insurance through progressive was $65 per month. Web domestic workers employed in private homes, like house cleaners and nannies.

Show ImageWorkers’ Compensation Insurance Requirements, Cost & Providers

These business insurance policies help protect your business from. The purpose of workers’ comp. Web workers’ compensation insurance is a specific type of insurance coverage required by law for nearly every business, with a few exceptions.

Show ImageGeneral Liability Insurance for Events Security Guards Companies

Web domestic workers employed in private homes, like house cleaners and nannies. Web most businesses should have both general liability and workers’ compensation insurance. Web in 2021, the national median cost for workers’ compensation insurance through progressive was $65 per month.

Show ImageLiability Coverage Definition Examples and Forms

It has a number of coverages available,. Web general liability and workers comp insurance for small business. Web they seem similar because they both, in part, offer protection against injuries.

Show ImageGeneral Liability vs. Workers’ Compensation Insurance What’s the

These business insurance policies help protect your business from. Thimble offers general liability insurance by the month or for individual events, making it a good option for businesses who want. Web general liability insurance protects a business against claims of bodily injury and property damage from customers and clients.

Show ImageFREE 13+ Sample Workers Compensation Forms in PDF XLS Word

General liability covers injuries that occur to people who visit your workplace. Web in 2021, the national median cost for workers’ compensation insurance through progressive was $65 per month. The purpose of workers’ comp.

Show ImageGeneral liability insurance for small business cost insurance

Thimble offers general liability insurance by the month or for individual events, making it a good option for businesses who want. Web general liability insurance protects a business against claims of bodily injury and property damage from customers and clients. Web workers’ compensation insurance policies cost an average of $45 per month.

Show ImageGeneral Liability Insurance For Sole Proprietor Workers Compensation

General liability covers injuries that occur to people who visit your workplace. Thimble offers general liability insurance by the month or for individual events, making it a good option for businesses who want. If you own a small business, your.

Show ImageSECURITY GUARDS > About Us > Education

Thimble offers general liability insurance by the month or for individual events, making it a good option for businesses who want. These types of claims may. The purpose of workers’ comp.

Show ImageGeneral liability covers injuries that occur to people who visit your workplace. Web domestic workers employed in private homes, like house cleaners and nannies. These business insurance policies help protect your business from. Web general liability and workers comp insurance for small business. Web check out esurance reviews, ratings, complaints & coverage for general liability, workers compensation and other small business insurance commercial policies. Web in most states, employer’s liability insurance is included as part of workers compensation insurance. Web most businesses should have both general liability and workers’ compensation insurance. Web in short, most as a small business owner you need both general liability and workers’ comp insurance. Web workers’ compensation insurance is a specific type of insurance coverage required by law for nearly every business, with a few exceptions. Web general liability insurance protects a business against claims of bodily injury and property damage from customers and clients.

Web they seem similar because they both, in part, offer protection against injuries. These types of claims may. If you own a small business, your. It has a number of coverages available,. Some states require workers’ comp coverage if these employees work more. Median costs for small business owners are: Along with general liability insurance, business owners often wonder about other. Web owning a small business can also be risky, which is why carrying mandatory and appropriate insurance coverage is important. The purpose of workers’ comp. Web in 2021, the national median cost for workers’ compensation insurance through progressive was $65 per month.

But there are four “monopolistic states” that do not include. This is based on the median cost of workers' comp insurance. Both general liability insurance and workers’ comp insurance. The average monthly price was $111. Web workers’ compensation insurance policies cost an average of $45 per month. Thimble offers general liability insurance by the month or for individual events, making it a good option for businesses who want. Small business insurance costs anywhere from about $14 to $124 a month, depending on which types you buy—general liability, commercial property,. Web commercial insurance can be affordable. Web in this video, we're going to cover what general liability and workers comp insurance are, and what they cover for small business owners.buying general liabi.